Join the Cause on Facebook: http://apps.facebook.com/causes/351801 The Biblical Model of Poverty Relief "At the end of every three years you shall bring out all the tithe of your produce in the same year and lay it up within your towns. And the Levite, because he has no portion or inheritance with you, and the sojourner, the fatherless, and the widow, who are within your towns, shall come and eat and be filled, that the LORD your God may bless you in all the work of your hands that you do." (Deuteronomy 14:28-29) "These will be the ways of the king who will reign over you: . . . He will take the tenth of your grain and of your vineyards. . . . He will take the tenth of your flocks, and you shall be his slaves." (1 Samuel 8:11,15,17)

The Old Testament contains numerous commands for individuals to give to the poor. “Blessed is he who is generous to the poor” (Prov. 14:21). “With the merciful you show yourself merciful” (Ps. 18:25). “The wicked borrows but does not pay back, but the righteous is generous and gives” (Ps. 37:21). However, there was no state welfare systemunder the law of Moses. The poor could glean from the fields after the harvest (Leviticus 23:22), they could hand-pick and eat from the crop growing in a farmer’s field (Deuteronomy 23:24-25; Matthew 12:1); they could receive zero-interest, collateralized loans (Exodus 22:25-26); and every third year the priests collected a tithe that was set aside for the poor (Deuteronomy 14:28-29). The state did not collect taxes from the rich to redistribute to the poor. A tax rate of less than ten percent, as required by 1 Samuel 8, would not allow for such a welfare program. In a Christian society, the church receives a “tax” that is greater than ten percent. The poor tithe seems to have been paid in addition to the regular tithe every third year,[1] which works out to 13.3% paid to the church annually on average, apart from freewill offerings for special needs that may arise. Even if you take the position that the tithe under the Law of Moses is not directly applicable to the New Covenant era, surely we should be no less generous to the poor under the New Covenant than under the Law of Moses! The New Covenant represents a transition from wrath to grace as a general principle after all (cf. Heb. 12:18-24). Jesus introduced His earthly ministry by proclaiming a new era of "good news to the poor" (Luke 4:18). Giving generously to the poor was a frequent theme of Jesus' teaching: Matthew 6:1-4, 19:16-21, 25:35-40; Luke 3:11, 12:33, 14:12-14; John 13:29. The beginning of the account of the widow's offering of two mites says of Jesus, "And he sat down opposite the treasury and watched the people putting money into the offering box" (Mark 12:41). R.J. Rushdoony comments, "Our Lord deliberately watched how people gave. We have no reason to believe He is less observant of us."[2] Immediately after the church formed after Peter's sermon on Pentecost, Christians showed extreme generosity to the poor by selling houses and land and bringing the money to the apostles to distribute: Acts 2:44-45, 4:32-37, 5:1-2, 6:1-3, 9:36, 10:1-2. This is more controversial, but Jesus said that His purpose, as a general principle, was not to overturn the law of Moses, and that those who don't obey the law better than the Pharisees demonstrate that they are not saved: "Do not think that I have come to abolish the Law or the Prophets. . . . Unless your righteousness exceeds that of the scribes and Pharisees, you will never enter the kingdom of heaven" (Matthew 5:17-20). The New Covenant not only secured forgiveness for violations of God's law, but it results in the law of God being written on the hearts of the redeemed, giving them a desire to obey the law (Heb. 8:10-12; cf. Rom. 8:7-9, Ezek. 36:27). Jesus taught that the Law and Prophets are summarized by the commands to love God and love your neighbor as yourself (Matt. 22:38-40; cf. Rom. 13:9-10), and Jesus certainly didn't come to undermine the obligation to love God or your neighbor. In the one case where Jesus mentions tithing specifically, He says to the Pharisees: "For you pay tithe of mint and anise and cumin, and have neglected the weightier matters of the law: justice and mercy and faith. These you ought to have done, without leaving the other undone" (Matthew 23:23-24). He rebukes them for neglecting the weightier matters of the law, while still affirming that being so meticulous in following the law of Moses that they tithed out of the spices in their garden was something that "you ought to have done." Since Christians should obey God's law better than the Pharisees, we ought to be meticulous about tithing as well. The frequent emphasis on giving generously to the poor in the New Testament is evidence against the idea that Christ replaced the commandments concerning charitable giving in the Old Testament with less generous requirements. With the Church receiving a higher tax rate than the state, in a Christian society the Church becomes a more influential institution than the state. The church cares for the poor, not the state. And unlike the state, the church gives the poor the moral uplift that they need to escape poverty, along with the material aid. This approach to poverty relief creates more productive, law-abiding citizens than the approach of welfare from the hand of a godless state, which lures the poor into a cycle of intergenerational poverty, breaks down the family, and increases crime. Whatever the government subsidizes, it gets more of. Paying people not to work will increase the number of people not working. Paying women to have babies when there is no father in the home will increase single-mother homes. The Great Society programs have destroyed black families in particular throughout the United States. The church can be more discriminating about who gets handouts, placing requirements on the recipients like work and listening to instruction on God’s solutions to their problems. When church charity began to be replaced by state welfare in the latter part of the 1800's, the main change in assumptions was from the Christian view that human nature is inherently sinful to the atheist view that human nature is inherently good.[3] If human nature is inherently good, then simply giving money to the poor will solve poverty. But if human nature is inherently sinful, then simply giving money to the poor will very often make the problem worse by subsidizing sin. Poverty is not always caused or perpetuated by sin, but in a nation as prosperous as the United States, with many people able to prosper who come from other nations and cultures and speak a different language, the poverty rate should be much less. Charles Murray's research would not have shown how welfare directed at a specific race, age-range and gender increases the joblessness of people in that specific category, if people were inherently good and just needed money to escape poverty.[4] If atheists were right, the casinos wouldn't see their business pick up every time welfare checks arrive in the mail.

God has established four governments with their own spheres of authority delegated to them by God: Self government, Family government, Church government, and State government. The biblical prescription for poverty puts responsibility for caring for the poor first with the individual, then the family, then the church as an institution of last resort. The job of the state is to protect the private property rights of everyone, rich and poor, not provide charity to the poor.

Liberal Faith in Salvation from the Beast: Liberals trying to find a justification for statist welfare in the Bible have argued that the Bible commands us to help the poor, and simply because of that, statist welfare is required by the Bible. They ignore how the Bible says the poor are to be helped. The state is given no commands to help the poor, unlike the other governments listed above, and it is restricted from collecting taxes in an amount that would allow support of an extensive welfare system. Some liberals have argued that the Biblical teaching of human sinfulness precludes relying on voluntary contributions to be the main source of helping the poor. Sinful humans will not voluntarily give enough to help the poor, so state coercion to fund welfare programs is necessary. They have also argued that statist tax-based welfare reduces the temptation to be prideful that is created in people who contribute to voluntary charity programs.[5] Yet the Apostle Paul specifically says that charity should be voluntary rather than coerced:

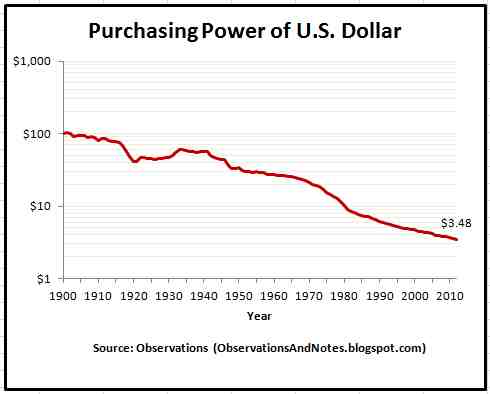

This claim that voluntary charity on the part of individuals is unbiblical because it creates pride in the givers also flies in the face of the many examples where individuals in the Bible are praised for their charity: The widow who gave her last two mites (Mark 12:42-44); the disciples who voluntarily sold their land and houses to provide for the poor among them (Acts 4:34-37); the disciple Tabitha who "was full of good works and acts of charity" (Acts 9:36); the centurion Cornelius, "a devout man" who "gave alms generously to the people" (Acts 10:2) and whose "alms have been remembered before God" (Acts 10:31); and the apostle Paul who was always mindful to carry alms from generous Christians to others in need: Galatians 2:10, Romans 15:26, Acts 24:17, 1 Corinthians 16:1-2, 2 Corinthians 9:5. Jesus, James, and John say that charity to the needy is the mark of an individual having true religion and faith in God (Matthew 25:34-40; James 1:27,2:15-16; 1 John 3:17-18). We cannot ignore the example of Christ on this issue of the Biblical legitimacy of the welfare State. When He performed the miracle of feeding the five thousand, the people wanted to make Him king. A king that could perform miracles to feed the entire populace would constitute the ideal welfare state. But Christ refused to become a welfare-state king and rebuked the people for having misplaced priorities: "When the people saw the sign that he had done, they said, 'This is indeed the Prophet who is to come into the world!' Perceiving then that they were about to come and take him by force to make him king, Jesus withdrew again to the mountain by himself. . . . 'Truly, truly, I say to you, you are seeking me, not because you saw signs, but because you ate your fill of the loaves. Do not labor for the food that perishes, but for the food that endures to eternal life, which the Son of Man will give to you.'" (John 6:14-15, 26-27) In general, the validity of these deductions from the sinfulness of humanity to support statist welfare is refuted by the low level of taxation allowed to the state, and the specific commandments of God's word, which set up a private, decentralized charity program, not a statist one. God's concern in many passages of the Bible, such as the account of the Tower of Babel in Genesis 11:1-9, the judgment against the oppressive "Leviathan" of Egypt in Exodus (cf. Psalm 74:12-14), the restrictions placed on kings in Deuteronomy 17:14-20, the description of tyranny in 1 Samuel 8, the judgments against a succession of empires in the book of Daniel, and the description of Rome as the seven-headed Beast in Revelation, is that centralized human authority, especially when joined with the power of coercive violence as possessed by the state, magnifies human sinfulness into a devouring beast. When God delivered the Israelites from the tyranny of Pharaoh, He set up a decentralized republic of twelve confederate states, with only an ad hoc judge providing unified political leadership (cf. Judges 8:22-23). Hundreds of years later when the Israelites asked for a king like the other nations, God told Samuel that the Israelites were rejecting God Himself as king (1 Samuel 8:7). The laws that God gave Israel did not set up a centralized, statist welfare program like Egypt had under Joseph (see more on this below). According to God's law, a state should not prosecute a person for trespassing who was gleaning from a farmer's land. But the state is given no command to confiscate wealth from the rich and redistribute it to the poor. In fact, God commands the state to not show favoritism to the poor: "Do not pervert justice; do not show partiality to the poor or favoritism to the great, but judge your neighbor fairly" (Leviticus 19:15). Rushdoony comments on the Ten Commandments and property rights: "It is significant that the Ten Commandments have four that protect the family and property and not one that protects the state. . . . The only institution which directly appears in the Ten Commandments is the family, and to it is clearly given authority over property by the whole of the law."[6] The eighth commandment is "Do not steal," which is said in the context of desiring to take (i.e. coveting) your neighbor's private property (the tenth commandment). Therefore using the taxing power of the state to take private property from one individual and give it to others is theft in violation of the Eighth Commandment. It has rightly been called "the politics of envy." A theme throughout the entire body of the law of Moses is the protection of individual property rights, like the punishment for letting a fire escape onto other's property and the restitution owed by a thief (cf. Exodus 22:1-15, Leviticus 6:1-5), with nothing about the right of the state to take private property to give to the poor. The poor are a concern in several places in the law of Moses, but as mentioned above, the means to help them is delegated to individuals, the family and church, not the state. Whatever pride is removed from private individuals by removing their responsibility to care for the poor becomes magnified in elite, powerful politicians. They begin to think of themselves as Saviors of the World because, by giving away other people's money, they become the source of life to the common people, whose vote can essentially be bought by the handouts. When you rob Peter to pay Paul, you can always count on Paul's vote (see this cartoon and this video). The state has the power to enforce its laws against anyone at the end of a gun barrel. Adding high taxes to fund its power of violence is like adding gasoline to a fire. Socialist-leaning Justice Oliver Wendell Holmes, Jr. said, "I like paying taxes. With them I buy civilization." But high taxes buy tyranny. Wars cost money, whether against foreign nations or against a nation's own people. Because of the state's power of violence, sin is able to wreak more destruction against more people through a highly-funded state than through any other human institution. This is tragically illustrated by the slaughter and slavery perpetrated by atheistic, socialistic regimes in the 20th Century that exceeded the abuse of power in all other centuries of human history combined.[7] In contrast to the elitism fostered in politicians by statist welfare, God's law is concerned with keeping the ruler humble, "that his heart may not be lifted up above his brothers" (Deuteronomy 17:20). The Biblical teaching against a powerful state is expressed well by Lord Acton's dictum that "Power tends to corrupt, and absolute power corrupts absolutely." While we are quoting Supreme Court justices, we should take note of Chief Justice John Marshall's observation about taxation: ". . . the power to tax involves the power to destroy. . ." (McCulloch v. Maryland, 1819). Taxes and regulations (which have the same effect on a business as a tax because they impose an additional cost on a business) can and have been used by large businesses, through the influence that they buy with campaign donations, to destroy or weaken smaller competing businesses. Do not assume that big business is pro-freemarket. If they can use the coersive power of the state for their benefit, many big businesses will. The result of business regulations promoted by big businesses is greater harm to the poor. Less competition increases prices, which hurts the poor. Businesses must pay for the tax or regulation somehow. They might have to fire some workers, and the lowest skilled workers are usually the first to go. They might freeze hiring, and again the lowest skilled workers often are the ones shut out of the jobs. They might reduce benefits, thereby exacerbating lack of adequate health care among the poor. They might increase the price of their products, thereby increasing the cost of living. The modern welfare state also receives a great deal of support from Keynesian economic theory. John Maynard Keynes believed that economic prosperity is ultimately a function of demand. He thought that if the national governments would print more and more money, or force taxpayers to pay high taxes so that their money would be spent by the government rather than saved by the individuals, the increased flow of the money in the economy would increase the real income of everyone. I can only give a brief of a critique of a major economic theory here. As everyone acknowledges, the Old Testament teaches that obedience to God’s law brings prosperity. When a nation is obedient, oppression ceases and poverty is eliminated. But what is not widely understood is that the Old Testament moral law is still valid under the New Covenant (Matt. 5:17), and those hopes of prosperity are realized under the New Covenant, including for the poor (Luke 4:17-21), therefore a nation’s obedience to God’s law will end poverty in the New Covenant age. Does God’s law command the Keynesian approach? No, just the opposite. God’s law calls a ten percent tax rate tyrannical and condemns those who dilute silver with dross (like printing fiat money) as thieves (Isa. 1:22-23). Production of goods and services that people want and need in a free market where profits provide the incentive and information to best meet the needs of consumers is what drives economic prosperity. The “progressive” economists of the twentieth century must be the greatest economic fools in history to think that the state can magically multiply wealth by printing more paper or taking people’s money and spending it for them.[8] As the graph, Purchasing Power of the U.S. Dollar, shows, their approach has devalued the U.S. dollar by over 95%. The elites who get the newly-printed money first have greater purchase power, but once everyone is receiving the greater amounts of cash, prices begin to rise proportionally. Of course, the poor are the last to realize the greater income, and prices may have begun to rise prior to that. It especially harms the elderly living on a fixed income because the money that they have saved becomes worth less as the money supply is increased. Also, taking as much money as possible from the productive members of society and redistributing it to the least productive makes the whole economy poorer. The graph below on poverty spending shows that state redistribution of wealth has had no effect on poverty levels. Another part of the tax policy of socialist-leaning economists is the progressive income tax. They argue that it is moral to tax the rich person at a higher rate than the poor because the rich person values his millionth dollar less than the poor person values his hundredth dollar. The poor person needs that dollar to buy food, clothing and shelter, while the rich person has those needs satisfied by the time he gains his millionth dollar. Yet that argument is a red herring.[9] The fact that the rich person needs that dollar less than the poor person to survive does nothing to prove that soaking the rich is the best way to lift the poor out of poverty. Taking the rich man’s dollar suppresses job production, and getting a job does more to help the poor man escape poverty than a handout, unless he is too disabled to work. The rich don’t hoard their money under a mattress; they invest it to make more money, which means the companies receiving the investment have more money to hire workers. As a second rejoinder to Justice Holmes, high taxes suppress the economy, and that hurts almost everyone except the powerful elite, but it hurts the poor the most. The only taxes in God’s law are a flat percentage tax (the tithe) and a head tax (a flat fee – Exo. 30:11-16). God is concerned for the poor, yet He obviously doesn’t think that a progressive income tax is the way to help the poor. Since tax percentages must be lower than ten percent, any progressive tax that meets that requirement would be a small percentage of increase for higher incomes. Many people in our day, both Christian and non-Christian, deny that the Bible is relevant to economic theory. They ignore the content of God's law and how the redemption secured by Christ results in greater obedience to God's law and worldwide material blessings. God's redemptive grace through the death and resurrection of Jesus Christ, which begins with redemption of individual hearts through the ministry of the Church, is powerful enough to substantially overcome the curse in this life: "For if, because of one man’s trespass, death reigned through that one man, much more will those who receive the abundance of grace and the free gift of righteousness reign in life through the one man Jesus Christ" (Romans 5:17). Redemption from the curse does not involve narrowly spiritual matters rather than earthly matters. All creation groans under the curse from the Fall of Adam (Romans 8:21-23). The curse from the Fall is the source of all the world's woes, including poverty; therefore Christ's redemptive power is the solution to poverty. Jesus announced, "The Spirit of the Lord is upon me, because he has anointed me to proclaim good news to the poor." (Luke 4:18) Jesus also acknowledged that "the poor will always be with you" (Matthew 26:11; cf. Deuteronomy 15:11), and indeed human perfection will never be achieved in anything on earth this side of the Last Judgment. But God's law is perfect, and following God's plan to help the poor, the best that imperfect people can, will always achieve the best results. Through our redemption by the Spirit of God, God has given us the power to obey His law, not perfectly, but substantially (Romans 5:17, 8:7-9; Heb. 8:6-12; 1 John 5:1-3). Success in relieving poverty is what God promised to the Israelites if they would obey His law: "But there will be no poor among you; for the Lord will bless you in the land that the Lord your God is giving you for an inheritance to possess—if only you will strictly obey the voice of the Lord your God, being careful to do all this commandment that I command you today" (Deut. 15:4-5). Since the New Covenant gives God's people the power to obey God's law that was deficient in the Old Testament, this allows the end of poverty to be substantially achieved, as promised in Deuteronomy 15:4-5, in lands where Christianity is widely and faithfully practiced. Liberals claim that churches can't replace government welfare because churches don't bring in nearly the amount of money that the modern state spends on welfare. First, this claim amounts to double counting. The church-based view presented here is not that current high rates of taxation should continue at the same time that the church is carrying the burden of poverty relief. If the state were not paying welfare entitlements, the tax rates could be much lower, and people would have more money to give to churches. Second, the same amount of money would not be needed. Church-based poverty relief would actually solve the problem of poverty to a great degree (see failure of the war on poverty in the United States in the graph above). This is true for two reasons. 1) A tax rate of less than 10% would astronomically increase the number of jobs and economic prosperity in general since much less money would be taken away from the business owners/job producers through taxation. A rising tide lifts all boats. 2) The moral uplift provided by Christian charities would help the poor reject the ways of thinking and habits that often lead to poverty and hinder escape from poverty. What liberals say can't be done has been done. In The Tragedy of American Compassion, Marvin Olasky shows how the church has been effective at caring for the poor in the past.[10]

Alleged Socialist Passages: A few specific passages in the Bible are cited by liberals as requiring a welfare state:

Getting from here to the Biblical model: In the United States and most of the world, we are far from the Biblical model of relieving poverty. The modern direction of nations is generally away from it and toward socialism, as with Obamacare. Merely cutting taxes and trying to defeat socialist healthcare legislation is not good enough. It will appear, rightly to an extent, that Christians don't care about the poor unless churches implement well-established, wide-spread programs of poverty relief that can replace the burden now carried by the state. Churches must teach the moral obligation of giving at least an annual one-third tithe exclusively to feed the poor, as well as providing programs of poverty relief that encourage work and self-sufficiency. Current high rates of taxation hinder church-based poverty programs by consuming funds that could go to church programs. This calls for this generation of Christians to give sacrificially to change things. The secularists aren't going to do it. They see the church as no more important than a knitting club. They don't see the church as an essential institution in a healthy society as the Bible teaches that it is. Christians must do what they can to give to the church at the levels that the Bible requires even while suffering taxation by the state at levels that far exceed what the Bible warns against. Along with your prayers, your giving to the poor will ascend as a memorial before God (Acts 10:4), and Jesus will take notice (Mark 12:41).

[I]f you pour yourself out for the hungry

For Further Reading:

The following books available for free at http://www.garynorth.com/freebooks: Endnotes: [1] http://www.biblestudy.org/bibleref/tithe-in-bible/three-tithes-of-israel.html |